B2B merchants typically handle a large volume of transactions and manual payments and need an extra layer of security and protection. This is why the best B2B payment processors offer lower processing fees, can accept MOTO (mail order/telephone order) payments through virtual terminals, offer invoicing, accept other varied types of payments, and should have fraud prevention and chargeback management tools.

Top B2B payment processors comparison

To easily compare my recommended B2B payment processors, I have listed their monthly and processing fees below, arranged according to their rating against our in-hours rubric. All providers offer Level 2 and 3 (aka B2B) credit card processing.

| Processing fee (starts at) | |||

|---|---|---|---|

| Interchange plus 0.15% + 15 cents | |||

| 2.9% + 30 cents | |||

| Interchange + 8 cents | |||

| 2.9% + 30 cents | |||

| 2.59% + 49 cents | |||

| 2% – 4.3% |

Helcim: Best overall

Our rating: 4.53 out of 5

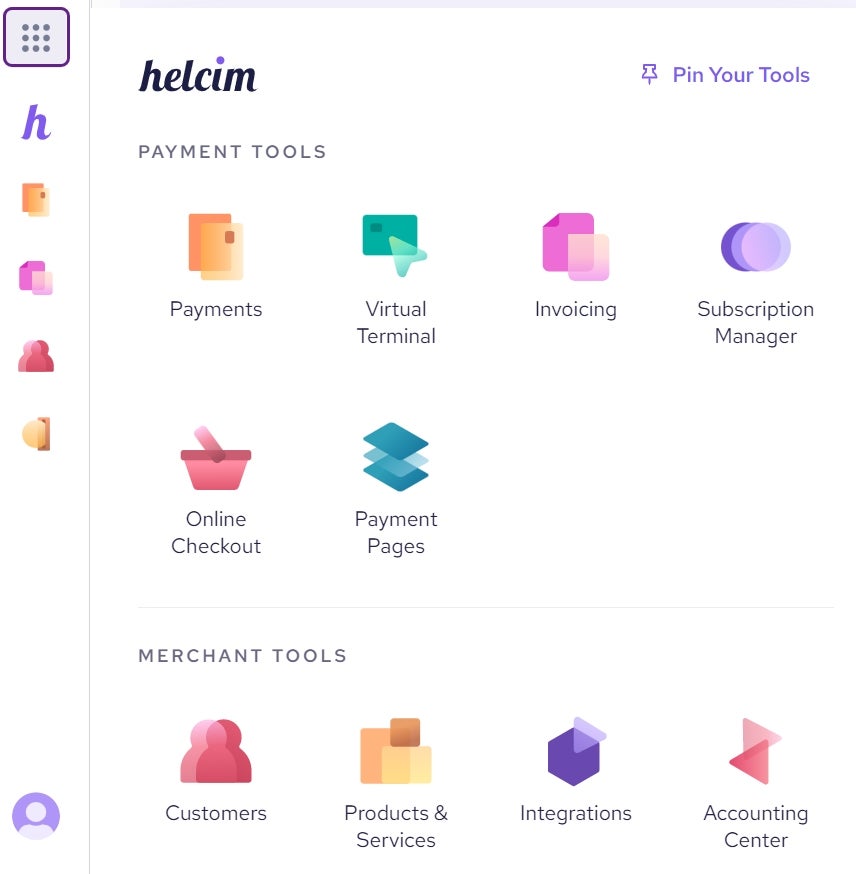

Helcim is my top pick for a B2B payment processor because its wide range of payment options (invoicing, recurring billing, and ACH payments) is well-suited for B2Bs. And, unlike other providers that charge a monthly fee or require a paid add-on to use a feature, Helcim has zero monthly fees, zero fees for other payment services, and offers interchange plus pricing. Moreover, Helcim’s automated volume discounts and zero-cost processing make it one of the cheapest B2B payment providers.

Why I chose Helcim

I like Helcim’s pricing transparency — zero cost processing, zero monthly fees, and automated volume discounts — it’s easily the cheapest B2B payment processor. It also has a free invoicing tool and customer portal that is very useful for B2B companies and their clients.

And unlike other B2B payment platforms like Stripe, Helcim has native Level 2 and 3 data processing and, with the help of AI, optimizes the interchange to automatically retrieve transaction information needed to qualify for Level 2 and 3 discounts.

Pricing

- Monthly fee: $0.

- Payment processing fees:

- Online: Interchange plus 0.15% + 15 cents to 0.50% + 25 cents.

- Keyed-in: Interchange plus 0.15% + 15 cents to 0.50% + 25 cents.

- Domestic ACH/Wire transfers: 0.5% + 25 cents

- Additional 0.10% + 10 cents for all AMEX transactions.

- Payment service fees:

- $0 for invoicing, recurring billing, international payments, and virtual terminal.

Features

- Interchange-plus pricing with automated volume discounts.

- Free international credit card payment processing – an international service fee (1%-3%) may be charged by your bank.

- All-in-one dashboard for managing payment processing tools.

- Customer self-service portal.

- Mobile payment app.

- Virtual terminal for all payment and transaction types.

- Invoicing for estimates, quotes, and account receivables.

- Recurring billing for subscription management.

- Guided chargeback dispute resolution.

- Credit Card Vault – store and protect customers’ credit cards on file.

- Fraud Defender – risk estimation done for each transaction for fraud and chargeback reduction.

- Fee Saver Program – a zero-cost processing program that supports online, invoice, and in-person payments. Helcim automatically detects the free credit card processing program available to use based on the card type/network and business location.

Pros and Cons

| Cons | |

|---|---|

|

|

Stripe: Best for international B2B payments

Our rating: 4.41 out of 5

Stripe can support more than 135 currencies and process payments up to $999,999.99, making it the best B2B payment solution for businesses that take international payments. It also supports the widest range of payments among all providers in my list, providing in-person and online/remote payments, wire transfers, ACH/e-checks, and cards — both domestic and international, as it has direct integrations with global card networks and issuers.

Why I chose Stripe

I like Stripe’s stable support for global payments — it currently has a presence in 46 countries, enabling you to accept payments in-person or remotely through a POS system or a webpage with real-time authorization. But its greatest strength is its customization options, where you might need to pay a little more for some features, such as building your own checkout solution.

B2B businesses can also benefit from Stripe’s invoicing tool and inexpensive ACH transaction fees — the lowest among the software in this list (0.8%, $5 cap), even Helcim (0.5% + 25 cents), because it has no cap limit. Stripe also offers custom interchange-plus rates for large-volume and enterprise-level companies, even though it offers flat-rate processing fees for the rest.

Pricing

- Monthly fee: $0.

- Payment processing fees:

- Online: 2.9% + 30 cents.

- Keyed-in: 3.4% + 30 cents .

- Domestic ACH debit: 0.8%, $5 cap.

- Custom rates available

- Payment service fees:

- Invoicing: Additional 0.4% to 0.5% per transaction.

- Recurring billing: 0.5% to 0.8% per transaction.

- International payments: 1.5%.

- Virtual terminal: Third party.

Features

- Support for local and international payments.

- Unified dashboard to manage business operations.

- Real-time and unified reporting tools, including deposit tracking.

- Hundreds of applications and custom APIs and SDKs for easy integration.

- Tools that can help create varied types of identity verification methods (KYC).

- Fraud prevention tool that has advanced payment, hardware and account protection tools, and secure data migration (Stripe Radar).

- One to two days deposit speed.

- 24/7 customer support, including technical support on Discord platform and for over 25 countries.

Pros and cons

| Cons | |

|---|---|

|

|

Stax: Best for high-volume B2B businesses

Our rating: 4.41 out of 5

Stax is well-suited for B2B companies that regularly process a large volume of transactions because it offers interchange optimization, like Helcim, but combines it with wholesale rates instead of interchange plus fees. This results in bigger savings.

Why I chose Stax

Even with its higher monthly fee compared to others in this list, Stax scored second to Helcim in my evaluation when it comes to pricing. Monthly plans can be a bit costly upfront. However, there are no long-term contracts with cancellation fees, and you’ll actually save because of the interchange and wholesale rates—but only if you frequently process large payments or a high volume of transactions each month.

I also like that Stax can work with most POS systems with integrations, unlike Helcim. Its subscription tools rival Braintree, my recommended solution for B2B subscription billing.

Pricing

- Monthly fee: $99–$199.

- Payment processing fees: Starts at Interchange + 18 cents.

- Volume discount: Wholesale subscription.

- Payment service fees: $0 for Level 2 interchange optimization; contact Stax for Level 3 data processing fees (if any).

Features

- Volume-based wholesale subscription rates.

- Compliant surcharging through CardX, Stax’s sister company.

- Automated recurring billing schedule for subscriptions and invoicing (Stax Bill).

- Customer self-service portal to monitor subscriptions.

- Customer relationship management (CRM).

- Multiple currency support via multiple gateways.

- Dispute management (Stax Connect).

Pros and cons

| Cons | |

|---|---|

|

|

Authorize.net: Best for integrations

Our rating: 4.29 out of 5

As one of the oldest, most trusted, and most popular platforms, Authorize.net is one of our top picks for best payment gateways. Its extensive integrations range from shopping carts and POS hardware to accounting and B2B platforms. It’s ideal for custom-built integrations as it comes with an open API for greater flexibility. You also won’t need as much coding or developer help with the customization, unlike Stripe, which also offers extensive integrations but requires coding knowledge and technical know-how.

Why I chose Authorize.net

Flexibility is one of Authorize.net’s greatest strengths. You can use the platform as a full payment processor or just as a payment gateway and go with a different merchant account. As a full payment processor, you can process cross-border, B2B payments, invoicing, and recurring transactions. The platform also seamlessly integrates with 900 platforms and works with 160 software developer platforms and more than 400 certified technology partners — the most extensive on my list.

Security is another area where Authorize.net shines. Its top-notch security and anti-fraud features can be further customized to your business needs — geographic limitations, payment velocity settings, minimum thresholds, and more. This level of security is considered premium and requires a paid upgrade for some providers, while Authorize.net provides its merchants this feature for free.

Additionally, Authorize.net provides support for high-risk merchants, similar to PaymentCloud. The rest of the providers on this list do not accept businesses in high-risk industries.

Pricing

- Monthly fee: $25.

- Payment processing fees: 2.9% + 30 cents;

- International payments: 1.5% per transaction.

- ACH: 0.75% per transaction.

- Verbal authorization: $1.20 per transaction.

- Payment service fees: $0 for recurring billing service, fraud detection, customer management.

Features

- Full Level 2 and Level 3 payment processing.

- Open API for more custom integrations or choose from 145 systems (from POS hardware to accounting systems).

- Partnered with 160 software development platforms.

- International payment processing with support for 13 currencies.

- Can subscribe to a payment gateway-only plan or an all-in-one plan that comes with a merchant account.

- Advanced Fraud Detection Suite (AFDS) tool composed on 13-rules based filters to identify, manage, and prevent suspicious and potentially fraudulent transactions.

- Customer Information Management (CIM) tool capable of saving cards on file and up to 10 payments and 100 shipping details.

- Can support high-risk merchants through its partners.

- Payout within 24 hours (no fees).

Image: Authorize.net

Pros and cons

| Cons | |

|---|---|

|

|

Braintree: Best for subscription B2B billing

Our rating: 4.20 out of 5

Braintree’s robust recurring billing tool is well-suited for B2B merchants that rely heavily on subscription models, such as those with regular supply orders. You can create custom subscription plans and set up discounts, rewards, add-ons, and promotional periods. You can also set automatic prorated billing for those who change subscriptions mid-month and accept multiple currencies and varied payment methods.

Why I chose Braintree

As a PayPal-owned company, Braintree specializes in online payments and offers full PayPal integration at no extra cost. I like its all-in-one solution — gateway, processor, and merchant account. You can process multiple payments in more than 130 currencies and 45 countries.

Similar to Helcim and Stripe, Braintree charges zero monthly fees, and its flat-rate processing rates are very competitive — the lowest among the providers on my list.

I like Braintree’s subscription or recurring billing features because it simplifies the management of complex payment workflows. Dunning management, automated prorated billing, discounts, promos, and rewards are just a few of the features you get with recurring billing. Stax offers dunning management, but Braintree covers more payment methods.

Pricing

- Monthly fee: $0.

- Payment processing fees:

-

- Online: 2.59% + 49 cents.

- Keyed-in: PayPal rates.

- ACH direct debit: 0.75% capped at $5.

- International payments: 1%.

- Payment service fees: $0 for invoicing, recurring billing, and virtual terminal.

Features

- Dedicated merchant account.

- Free and seamless PayPal integration.

- Accepts Venmo payments.

- Recurring billing tool to create custom subscription plans.

- Secure platform with fraud prevention tools, can be upgraded to premium for a fee to get more flexibility and control over fraud prevention strategy.

- Account updater that updates customers’ Visa, Mastercard, or Discover Card details — such as numbers, expiration dates, and account status changes (paid add-on).

- Payouts in two to three business days.

Pros and cons

| Cons | |

|---|---|

|

|

PaymentCloud: Best for high-risk B2B merchants

Our rating: 4.11 out of 5

PaymentCloud specializes in providing merchant services to businesses belonging to high-risk industries. If you find it hard to get accepted with payment processors or merchant services, PaymentCloud will be a good fit for you. Large-volume and card-not-present (such as MOTO (mail order/telephone order) and manual/keyed-in) transactions are normal when it comes to B2B and high-risk merchants, and PaymentCloud provides these services with a wide range of accepted payment methods.

Why I chose PaymentCloud

I chose PaymentCloud because of its excellent customer service; it’s the only one with perfect scores for user reviews, along with Stax. Like Authorize.net, it supports a wide range of high-risk merchants, but unlike the former, PaymentCloud specializes in servicing high-risk industries — with a same-day setup upon approval and a reported 98% approval rate.

I also like that PaymentCloud can work with any payment gateway. It can also provide a payment gateway with Level 2 and 3 data processing needed by most B2B merchants.

While PaymentCloud doesn’t post its exact pricing, this is expected because of its custom pricing for high-risk merchants. It provides added fees for usual service fees such as invoicing and virtual terminals that are normally free for other providers, but since it services high-risk merchants, this is also to be expected.

Pricing

- Monthly fee: $10 to $45.

- Payment processing fees:

- Online/Invoice: 2% to 4.3%.

- Keyed-in: 2% to 4.3%.

- International payments: 1% to 2%.

- ACH and echeck: Contact PaymentCloud.

- Payment service fees:

- Invoicing and recurring billing: $0.

- Virtual terminal: $15 to $45.

- Payment gateway: $15 per month.

Features

- Specializes in high-risk merchants with a 98% approval rating with its more than 10 banking partners.

- Custom pricing.

- Supports cryptocurrency payments.

- Chargeback protection – partnership with Chargeback Gurus to detect, track, and resolve disputes on behalf of merchants.

- Strong fraud prevention – AVS technology, tokenization, P2PE data encryption, and 3D Secure technology.

- Next-day funding.

Pros and cons

| Cons | |

|---|---|

|

|

How do I choose the best B2B payment processor for my business?

To choose the right B2B payment solution for your businesses, it is critical that you learn more about your business operations first.

- Take a look at your business’s transaction volume and average transaction value.

- Know the various software your business is currently using.

- List down all the payment methods you currently accept and which channels they usually go through (online, in-person, ACH, and more).

From there, gather a list of B2B processing companies. Evaluate the pricing structure of each B2B payment gateway. Consider the total cost — transaction fees, monthly fees, and any additional charges. If your business has a high volume of transactions, choose B2B payment processing companies that offer interchange-plus pricing models (such as my top pick, Helcim). They can offer significant savings.

Then, take a look at B2B payment platforms that have integrations with your existing business systems (accounting, CRM, for example) to ensure a seamless integration with your business operations. B2B payment providers like Stripe and Authorize.net are renowned for their extensive integration capabilities.

Consider also the payment methods these platforms support, and whether they offer invoicing and recurring billing, or subscription services. If you have a global business and take payments in different currencies, go with a payment processor that supports multiple currencies and offers favorable exchange rates. Stripe is known for its international payment functionalities, while Braintree has robust B2B subscription models.

Finally, read each provider’s user reviews. The ability to deliver 24/7 support is critical to resolving issues quickly, but the quality of support should also be looked into.

As a B2B company, you will benefit from a provider that provides scalability and flexibility as your business needs change and grow. Helcim, my top recommended B2B payment processor, is able to provide support with its comprehensive features to scale your business.

Methodology

Leveraging my experience helping retail businesses build their ecommerce stores and providing support to B2B businesses that need to accept B2B payments, particularly multiple currencies, I looked at popular and equally highly-rated payment processors that offer Level 2 or Level 3 processing.

From my initial list, I graded them using an in-house rubric of 26 data points based on pricing and contract terms, payment types, account features, security and user experience, and real-world user and expert reviews.

This article and methodology were reviewed by our retail expert, Meaghan Brophy.

Frequently Asked Questions (FAQs)

What are B2B solutions?

Business-to-business (B2B) solutions are specifically created to help other businesses improve and streamline their operations, reduce costs, and, more importantly, generate and increase revenue. Typical examples include software platforms, marketing tools, and supply chain management systems.

What is the typical B2B payment process?

A B2B transaction occurs between two businesses, so the payment process is a bit different from that of a B2C (business to consumer) payment. The B2B payment process usually starts with the seller issuing an invoice for the buyer. The invoice then needs to get approved from the buyer’s (other business) side, and once approved, payment is prepared — by wire transfer, ACH, or other method.

Once payment is sent, it is validated and authorized. And once it is received in the seller’s bank account, the seller reconciles the payment and updates the buyer’s records.

What is the difference between P2P and B2B payments?

The main difference between B2B (business to business) and P2P (peer-to-peer) payments is the speed of transaction — from issuing and receiving payments. Unlike P2P payments where transactions are typically smaller, payments are instant, and receivers usually get the funds in their account right away.

B2B payments are more complex than B2C (business to consumer) and P2P payments, as they usually undergo a lot of steps. The transactions are typically larger and are usually received after the transaction (exchange of products or services) has happened. B2B payments go through invoicing, approval, preparation, issuing, validation, and receiving before they are finally acknowledged and recorded on the buyer’s end.

How much do B2B payments cost?

B2B payments typically cost more than B2C payments because of the volume transaction, but payment service providers offer volume discounts to B2B companies. So, while the overall cost is higher, the percentage that processors charge for B2B payments is often lower.